The condom market in India has shown significant growth and is poised for further expansion in the coming years. Here are some key statistics and insights into the condom market in India:

Market Size and Growth:

- The Indian condom market was valued at approximately USD 183.46 million in 2018 and is projected to reach USD 508.36 million by 2027, growing at a CAGR of 12.2% (Business Market Insights).

- The market size is expected to expand at a CAGR of 7.4% from 2024 to 2030 (6Wresearch).

Key Market Drivers:

- Increasing awareness about safe sex practices and rising disposable incomes are major factors driving market growth.

- Government initiatives promoting family planning and sexual health have contributed significantly to market expansion.

- The availability of a variety of condoms, including flavored, textured, and ribbed, also supports market growth (6Wresearch).

Consumer Demographics:

- A significant portion of the Indian population is young, with 50% below 24 years of age and 65% below 35 years, which represents a large potential market for condoms (Grand View Research).

- Awareness regarding sexual wellness products is increasing among this demographic, contributing to higher adoption rates.

Distribution Channels:

- Public health distribution channels dominate the market, with a significant share attributed to government and non-governmental organization (NGO) efforts to promote condom use for HIV and STI prevention.

- E-commerce is the fastest-growing distribution channel, driven by the increased penetration of the internet and smartphones, making it easier for consumers to purchase condoms discreetly online (Grand View Research).

Challenges:

- Social stigma and embarrassment associated with purchasing condoms remain significant challenges in India.

- Competition from other contraceptive methods, such as oral pills and intrauterine devices (IUDs), also poses challenges to the growth of the condom market (6Wresearch).

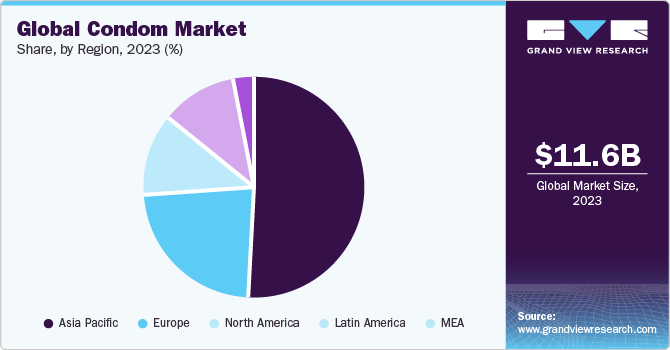

Regional Insights:

- Urban areas account for 72% of the value and 65% of the volume of condom sales in India, highlighting the concentration of market activity in more developed regions (Grand View Research).

- The North Zone of India shows strong brand and flavor preferences, contributing significantly to overall sales (Business Market Insights).

Key Players in the Market

The condom market in India is highly competitive with numerous major players. Some of the prominent companies include:

- Manforce: Leading the market with a 32% share.

- Durex: Holds a 14% market share.

- Kamasutra: Also has a 14% market share (Grand View Research).

Chart conventions

- Manforce 32

- Durex 14

- Kamasutra 14

Key Condom Companies:

The following are the leading companies in the condom market. These companies collectively hold the largest market share and dictate industry trends.

- FUJILATEX CO.,LTD

- Reckitt Benckiser Group PLC

- Church & Dwight Co., Inc.

- Karex Berhad

- LELO iAB

- Lifestyles

- Veru Inc.

- Okamoto Industries, Inc

- MAYER LABORATORIES, INC.

- Cupid Limited

- RITEX GMBH

- Pasante Healthcare Ltd.

- CPR GmbH

- Mankind Pharma

- Sagami Rubber Industries Co., Ltd.

- rrtMedcon

Conclusion

The condom market in India is growing rapidly, driven by increasing awareness, government initiatives, and the rise of e-commerce. Despite challenges such as social stigma and competition from other contraceptive methods, the market is expected to continue expanding, offering significant opportunities for manufacturers and distributors.

For more detailed reports and data, you can explore resources from Grand View Research, 6Wresearch, and Business Market Insights.

Please rate my work

Your page rank: